Navigating the Vancouver Island Real Estate Market: Trends and Insights for 2023

As we venture into 2023, the real estate market on Vancouver Island presents a landscape full of nuanced trends and significant shifts. From legislative changes to evolving market dynamics, understanding these trends is key for anyone engaged in the real estate sector here.

Legislative Changes: A New Landscape for Transactions The introduction of a new three-day rescission period is a notable change in the real estate transaction process. However, its impact on the Vancouver Island market is expected to be minimal. This change aims to add a layer of security and decision-making comfort for buyers, reflecting a more cautious and calculated approach to real estate transactions in the current market climate.

Simultaneously, the federal government's ban on foreign buyers, effective from January 2023, is another legislative change. While there is a general perception that this might impact the market, Vancouver Island's unique appeal to international buyers, many of whom are Canadians living abroad or have strong ties to Canada, softens the potential impact of this ban.

Rental Market Dynamics and Price Trends The rental market on Vancouver Island has been witnessing a steady increase, a trend likely to continue into 2023. This steady rise in rental costs, coupled with a limited number of new constructions, suggests a robust rental market. For investors, this translates into a potentially lucrative opportunity, especially in high-demand areas.

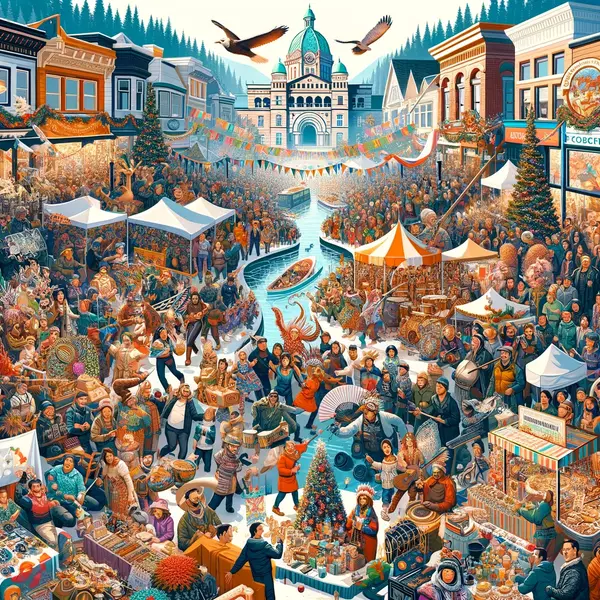

In terms of property prices, while there is a general stabilization across the region, certain areas are witnessing an uptick due to factors like sustainability initiatives and demographic shifts. Properties that align with environmental consciousness or are situated in areas experiencing cultural revitalization are particularly noteworthy.

Investing in New Construction: A Calculated Risk with Potential Rewards New construction projects on Vancouver Island carry inherent risks but also offer significant rewards for discerning investors. The region's slower pace in infrastructure development compared to larger cities provides a less competitive landscape for buyers. This scenario presents a unique opportunity for investors to tap into new constructions at potentially lower price points, offering long-term value.

Categories

Recent Posts